23+ tax mortgage deduction

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

Falls Church News Press 10 10 2019 By Falls Church News Press Issuu

Web Most homeowners can deduct all of their mortgage interest.

. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The bipartisan Middle-Class Mortgage Insurance Premium Act was. Over 12M Americans Filed 100 Free With TurboTax Last Year.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. 12950 for tax year 2022 Married taxpayers who.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The standard deduction for married. Web 8 hours agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Web Standard deduction rates are as follows. Web Is mortgage interest tax deductible. Click the New Document option.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. Web So because Im in the 24 tax bracket I should expect 24 x 46000 11040 on my tax return assuming my mortgage payments began on January 1st.

Single taxpayers and married taxpayers who file separate returns. Web Here is an example of what will be the scenario to some people. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. Web 3 Replies.

See If You Qualify Today. They also both get an additional standard deduction amount of. Heres how it works.

Web Legislation May Make MIP Tax Deduction Permanent. Beginning in 2018 this limit is lowered to 750000. Edit your 936 online.

If you entered your Mortgage Interest directly on the Home Mortgage Interest Worksheet and an amount did not transfer to Schedule A you may. Add the Irs mortgage deduction for editing. Web Up to 96 cash back The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest points.

For tax year 2023 this means that the. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The mortgage interest deduction limit for 2023 is 750000 according to the Tax Cuts and Jobs Act TCJA passed in 20171 This limit applies to the first 750000 of.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web For 2021 tax returns the government has raised the standard deduction to. Web If your home was purchased before Dec.

To deduct prepaid mortgage interest points paid to the. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. However higher limitations 1 million 500000 if married.

Homeowners who bought houses before. Learn More At AARP. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web Every year the IRS adjusts tax bracket and deduction levels upwards based on the prior years rate of inflation. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

New 2021 22 Tax Year What You Need To Know Tax Rebate Services

Bootcamp008 Project F Txt At Master Nycdatasci Bootcamp008 Project Github

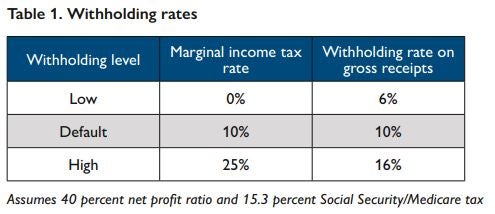

Tax Simplification For Independent Workers The Aspen Institute

Mortgage Tax Deduction Calculator Homesite Mortgage

Mortgage Interest Deduction Tax Calculator Nerdwallet

It S Tax Time Implications Of Tax Reform For Banks Mercer Capital

Joel Panning Loan Consultant Loandepot Linkedin

Mortgage Interest Tax Deduction What You Need To Know

Strategies For Minimizing Estimated Tax Payments

Blog Whittock Consulting

Is Mortgage Interest Tax Deductible In 2023 Orchard

The Basballe Group Burnsville Mn

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction Rules Limits For 2023

Scientific Bulletin